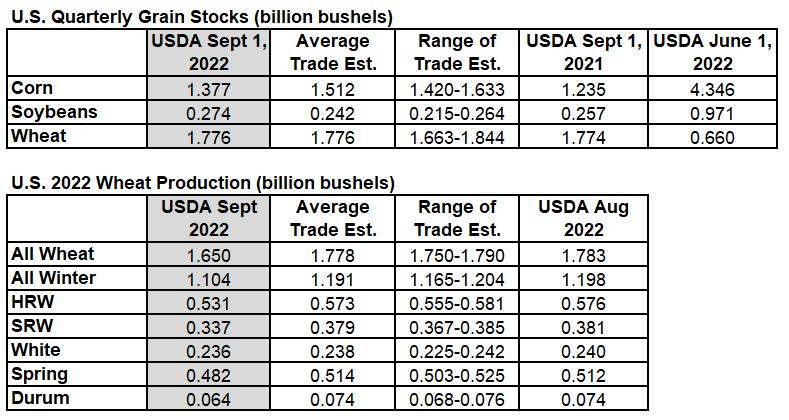

Corn stocks under the smallest trade estimate. Bean stocks larger than expected. Wheat exactly as expected.

Source: StoneX, Reuters

The smaller than expected corn stocks drove corn prices up through the 20-day moving average, with Friday?s high (at this writing) nearly reaching the September price peak. Technical traders will view today?s performance as a positive event as well as fundamental traders that have smaller beginning stocks for the crop year.

Corn prices have been in a relatively narrow trading range during the month of September and Friday?s report could give us the price thrust up to a Sell Signal.

Bigger supplies of soybeans to start the new crop year prevented beans from clearing the green line 20-day moving average Friday. Beans have been in a broad trading range since early August and next week, prices will be back down challenging support and adding days to our Buy Signal. There is a gap left on the November bean chart at $13.50, which will likely be a downside target for technical traders.

The just finished wheat harvest was estimated to be smaller than the last USDA estimate and 128 million bushels smaller than traders expected. Prices surged up above the recent high and will likely give us Sell Signals early next week. On the next Sell Signal our advice will be to cover 30-60 days? worth of cash needs.

Increased uncertainty in Ukraine and Russia has been positive to prices this week and will be closely watched next week.

From the USDA Grain Stocks report:

Old crop corn stocks in all positions on September 1, 2022 totaled 1.38 billion bushels, up 12 percent from September 1, 2021. Of the total stocks, 510 million bushels are stored on farms, up 29 percent from a year earlier. Off-farm stocks, at 867 million bushels, are up 3 percent from a year ago. The June – August 2022 indicated disappearance is 2.97 billion bushels, compared with 2.88 billion bushels during the same period last year.

Based on an analysis of end-of-marketing year stock estimates, disappearance data for exports, and farm program administrative data, the 2021 corn for grain production is revised down 41.4 million bushels from the previous estimate. Corn silage production is revised down 888 thousand tons.

2021 planted area is revised to 93.3 million acres, and area harvested for grain is revised to 85.3 million acres. Area harvested for silage is revised to 6.45 million acres. The 2021 grain yield, at 176.7 bushels per acre, is down 0.3 bushel from the previous estimate. The 2021 silage yield, at 20.1 tons per acre, remains unchanged from the previous estimate. A table with 2021 acreage, yield, and production estimates by States is included on pages 17 and 18 of this report.

Old crop soybeans stored in all positions on September 1, 2022 totaled 274 million bushels, up 7 percent from September 1, 2021. Soybean stocks stored on farms totaled 62.9 million bushels, down 8 percent from a year ago. Off-farm stocks, at 211 million bushels, are up 12 percent from last September. Indicated disappearance for June – August 2022 totaled 698 million bushels, up 36 percent from the same period a year earlier.

Based on an analysis of end-of-marketing year stock estimates, disappearance data for exports and crushings, and farm program administrative data, the 2021 soybean production is revised up 30.2 million bushels from the previous estimate. Planted area is unchanged at 87.2 million acres, but harvested area is revised to 86.3 million acres. The 2021 yield, at 51.7 bushels per acre, is up 0.3 bushel from the previous estimate. A table with 2021 acreage, yield, and production estimates by States is included on page 19 of this report.

Special Note

The marketing year for corn and soybeans is finished and a thorough review of the balance sheet was completed. This process, which is normal for this time of the year, led to revisions in acreage, yield, and production for the 2021 crop.

U.S. corn production for 2021 is revised down 41.4 million bushels and U.S. soybean production is revised up 30.2 million bushels from the previous estimate. All revisions can be found on pages 17-19.

All wheat stored in all positions on September 1, 2022 totaled 1.78 billion bushels, up less than 1 percent from a year ago. On-farm stocks are estimated at 591 million bushels, up 41 percent from last September. Off-farm stocks, at 1.18 billion bushels, are down 13 percent from a year ago. The June – August 2022 indicated disappearance is 543 million bushels, down 24 percent from the same period a year earlier.