USDA Stocks and plantings positive to wheat, Plantings positive to corn, negative to beans

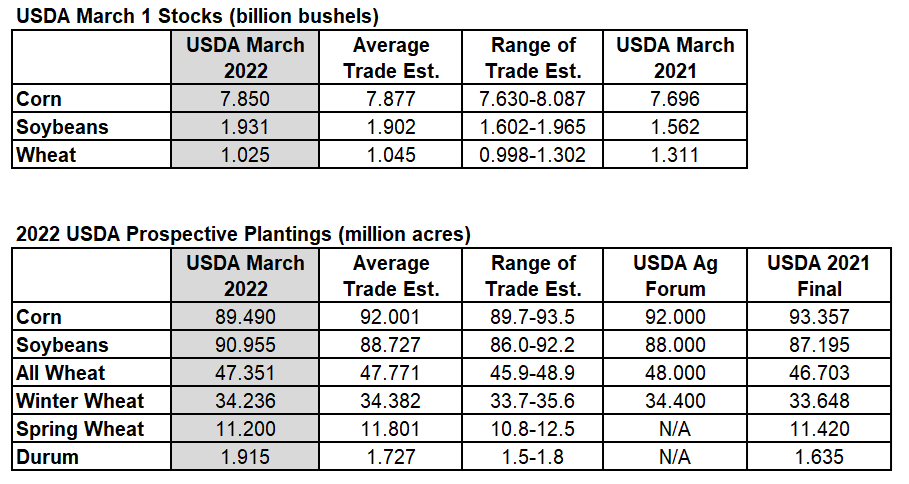

The USDA Quarterly Stocks report was not far off trade expectations for any of the crops. Corn and wheat stocks were both slightly lower, while bean stocks were slightly higher than the average trade guess.

The biggest surprise came in Prospective Plantings. Farmers indicated they would plant 89.4 million acres of corn, 2.5 million acres less than traders thought. Farmers indicated 2.2 million more acres soybeans instead.

After the aggressive market shakeout this week, the USDA report was released with many traders chased to the sidelines. Corn and wheat prices shot higher following the report, with July and December corn posting new life of contract highs.

Bean prices initially fell following the reports but so far have held well above the low of this week?s range.

Wheat prices surged higher and ended our Buy Signal in Chicago wheat. Wheat prices are still trading under the green line 20-day moving average, which is the next target for this upside move.

The December corn acreage was reported 210,000 acres below the lowest trade estimate. Corn prices got a shot in the arm from that number. Weather becomes more important with these smaller acres.

Other than corn acreage, there wasn?t much in the numbers today (at first blush) to push prices very far outside of their recent trading ranges.

Source: USDA, Reuters, StoneX