USDA Surprises Traders with Fewer Bean Plantings

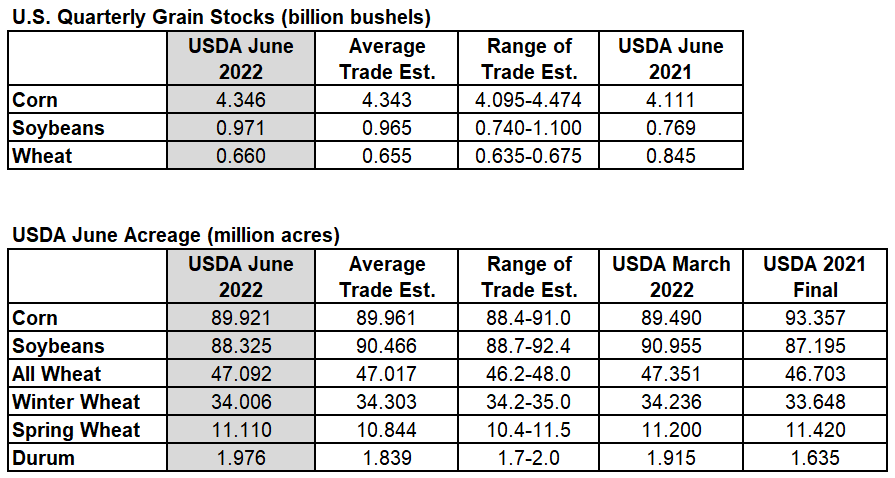

The U.S. corn acreage was 40,000 acres less than expected, about half a million acres larger than the March intentions, but about 3.5 million acres smaller than last year?s final number.

Beans had the most surprising number, coming in 2.1 million acres below expectations and 2.6 million acres below the March estimate. However, today?s bean planting estimate was still 1.1 million acres larger than last year?s final number.

Wheat plantings were 75,000 acres larger than trade expected and 259,000 acres smaller than the March estimate, but 389,000 acres larger than last year?s final number.

U.S. corn stocks were almost exactly what the trade expected and totaled 235 million bushels larger than last year at this time.

Bean stocks were 5 million bushels larger than the trade expected and totaled 202 million bushels larger than last year.

Wheat stocks were 5 million bushels larger than trade expectations and down 185 million bushels from last year.

Markets will continue their focus on weather, with increased importance for beans.

Source: USDA, Reuters