New crop corn and beans posted new lows but wheat surged higher

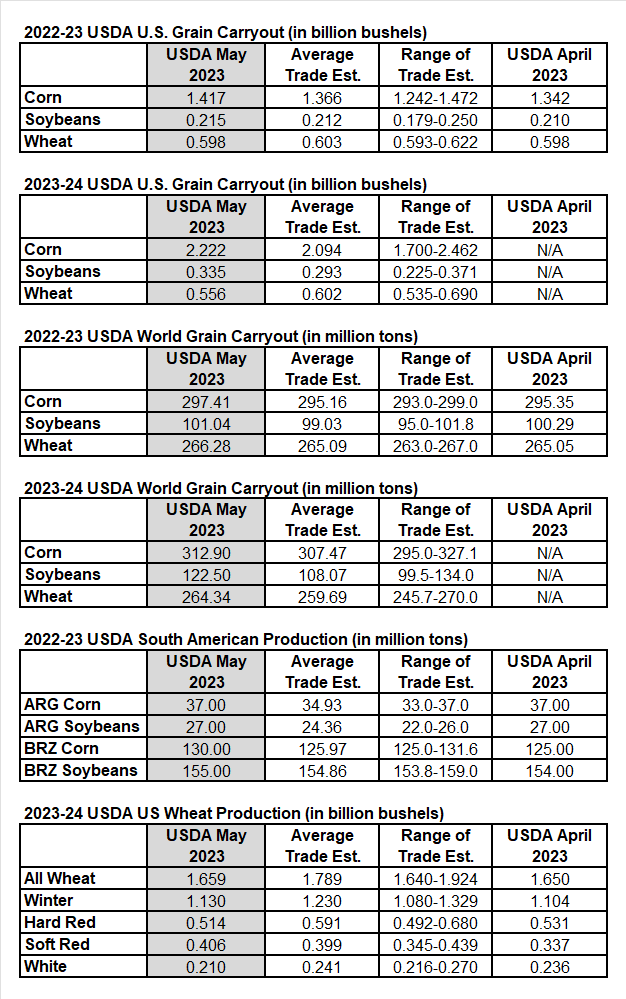

US old crop corn carryout increased 75 million bushels from last month, which was 50 million bushels larger than the trade expected. Old crop bean and wheat carryout were virtually unchanged as the trade expected.

In the USDA?s first estimate for 2023-24, corn carryout came in at 2.22 billion bushels, up 800 million bushels from this fall?s forecast. Bean carryout for 2023-24 at 335 million bushels is up 120 million bushels from this fall?s estimate. Wheat carryout for next year was pegged down 42 million bushels from this year.

One of the biggest number changes came in the Brazilian corn crop, now estimated to be 130 million tons, up 5 million tons from last month. The 2023-24 world corn carryout was projected up 15.5 million tons from this fall?s estimate.

The 2023-24 world soybean carryout came in at 122.5 million tons, up 21.5 million from this year?s estimate.

World wheat carryout for 2023-24 slipped about 2 million tons year over year.

The market reaction has been negative for new crop corn and beans with these larger than expected production and carryout numbers. Kansas City wheat surged up to its resistance at $9/bushel for the July 2023 contract.

This week prices tried to rally but only Kansas City wheat and Minneapolis wheat were able to make gains. Technical selling pressure, better than normal planting progress, and a decent weather forecast stopped the corn and bean rally this week. Today?s report drove prices to new lows.

Source: USDA, Bloomberg, StoneX