USDA lowered US corn yield estimate but left beans unchanged

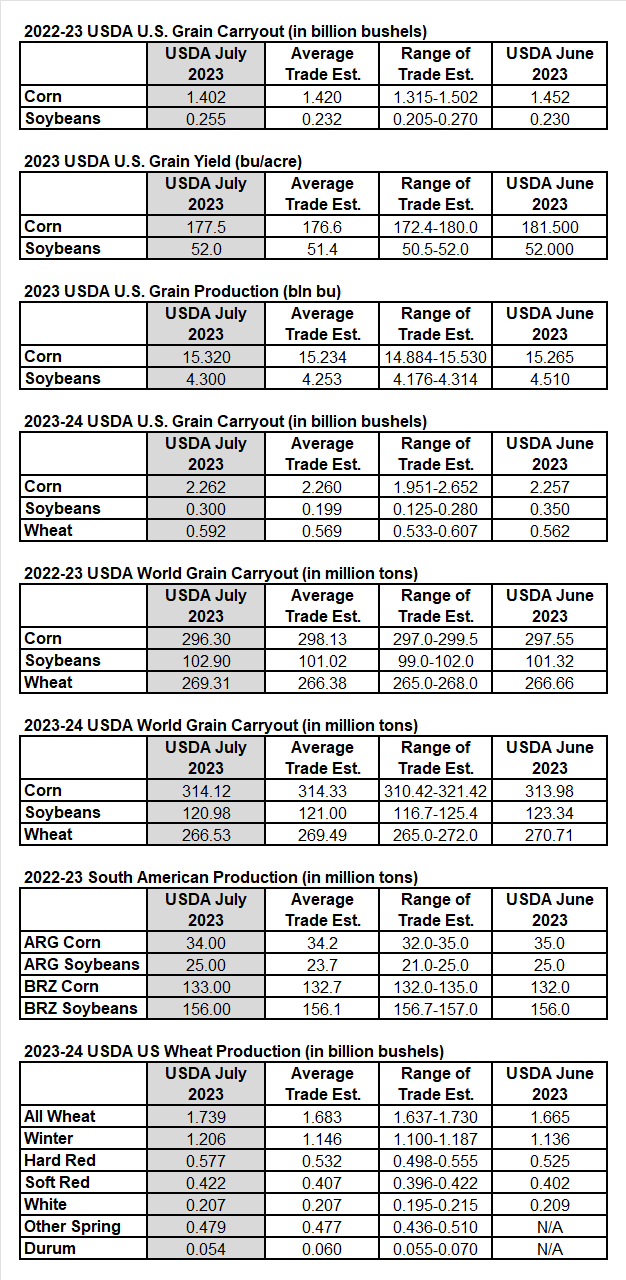

The USDA lowered their US corn yield estimate from 181.5 to 177.5 bushels per acre this month, while they left their US bean yield estimate unchanged at 52.0 bpa. Trade was expecting lower yield estimates for both (176.6 & 51.4 bpa, respectively). This put their 2023 production estimates above trade expectations.

The USDA estimates for next year?s carryout (2023-24) were larger than trade expected for corn, beans, and wheat. Of note, their 2023-24 soybean carryout estimate was 300 million bushels, 50% above the 199 million bushel average trade estimate.

Soybean prices dropped 40 cents lower on the larger than expected bean carryout.

In South America, the USDA offset changes in corn production by lowering their Argentine estimate 1 million tons at the same time they increased their Brazilian corn production estimate 1 million tons. They left their South American soybean production estimates unchanged from last month.

Total wheat 2023-24 wheat production was larger than trade expected. The USDA increased their total wheat production estimate by 74 million bushels to 1.739 billion bushels. Trade was expecting a smaller increase to just 1.683 billion bushels.

From the WASDE report

Corn

This month?s 2023/24 U.S. corn outlook is for fractionally higher supplies and ending stocks. Corn beginning stocks are lowered 50 million bushels, as greater feed and residual use for 2022/23 more than offsets reductions in corn used for ethanol and exports. Corn production for 2023/24 is forecast up 55 million bushels as greater planted and harvested area from the June 30 Acreage report is partially offset by a 4.0-bushel reduction in yield to 177.5 bushels per acre.

According to data from the National Centers for Environmental Information, harvested-area-weighted June precipitation data for the major Corn Belt states represented an extreme downward deviation from average. However, timely rainfall and cooler than normal temperatures for some of the driest parts of the Corn Belt during early July is expected to moderate the impact of June weather. For much of the crop the critical pollination period will be in the coming weeks. With supply rising fractionally and use unchanged, ending stocks are up 5 million bushels. The season-average farm price received by producers is unchanged at $4.80 per bushel.

Soybeans

U.S. oilseed production for 2023/24 is projected at 127.6 million tons, down 5.6 million from last month with reductions for soybeans and sunflower seed, partly offset by higher canola and peanuts. Soybean production is projected at 4.3 billion bushels, down 210 million on lower harvested area. Harvested area, forecast at 83.5 million acres in the June 30 Acreage report, is down 4.0 million from last month. The soybean yield forecast is unchanged at 52.0 bushels per acre. With lower production partly offset by higher beginning stocks, 2023/24 soybean supplies are reduced 185 million bushels.

Soybean crush is reduced 10 million bushels reflecting a lower soybean meal domestic disappearance forecast. Soybean exports are reduced 125 million bushels to 1.85 billion on lower U.S. supplies and lower global imports. With lower supplies only partly offset by reduced use, ending stocks for 2023/24 are projected at 300 million bushels, down 50 million from last month. The U.S. season-average soybean price for 2023/24 is forecast at $12.40 per bushel, up $0.30 from last month. The soybean meal price is projected at $375.00 per short ton, up $10.00. The soybean oil price forecast of 60.0 cents per pound is up 2 cents.

The Environmental Protection Agency (EPA) issued the final renewable fuels standards rule for 2023, 2024, and 2025. The 2023 biomass-based diesel volume mandate was unchanged from the proposal published last December. For 2024, EPA increased the non-cellulosic advanced biofuel volume mandate but lowered the implied conventional volume. USDA assumes that biomass-based diesel would be produced in excess of the advanced biofuel volume mandate to make up the shortfall in conventional renewable fuel to meet the total renewable fuel obligation. With the offsetting changes compared to the proposal in 2024, there is no change to soybean oil used for biofuel for 2023/24 this month.

Wheat

Changes this month to the 2023/24 U.S. wheat outlook increase supplies and domestic use, leave exports unchanged, and increase ending stocks. Supplies are raised on larger production, which is up 74 million bushels to 1,739 million, on higher harvested area and yields. The first 2023/24 survey-based production forecast for other spring and Durum indicates a decrease from last year. Conversely, winter wheat production is forecast higher on larger harvested area and higher yields. Gains for all wheat production are partly offset by smaller beginning stocks, which are lowered 18 million bushels to 580 million as indicated in the Grain Stocks report, issued June 30. The 2023/24 ending stocks are forecast at 592 million bushels, 30 million higher than last month. The projected season-average farm price is forecast at $7.50 per bushel, down $0.20 from last month.

This month provides the first by-class 2023/24 U.S. wheat supply and use projections. Two consecutive years of drought-affected Hard Red Winter (HRW) wheat crops reduce HRW ending stocks to the lowest level in 16 years despite decreased total use. HRW food use is forecast to be the smallest since 2010/11, while HRW exports are the lowest since by-class supply and utilization records began in 1973/74.

Source: USDA/Reuters/StoneX