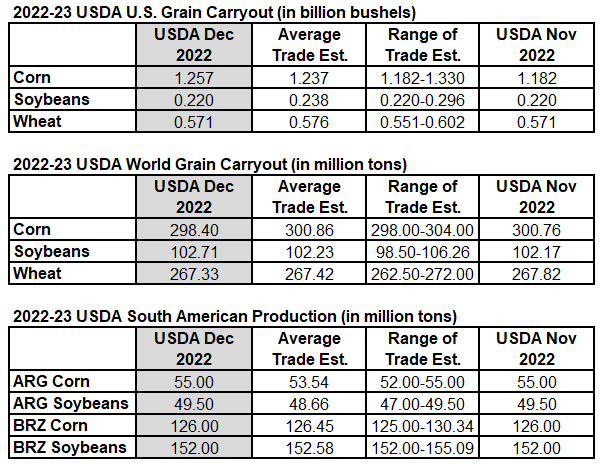

The USDA made few changes to their supply demand numbers in the December WASDE report.

They made no changes to their US wheat and soybean supply demand numbers.

They cut US corn exports by 75 million bushels, acknowledging the slow pace of corn sales and shipments. This increased their US corn carryout total by 75 million bushels.

There were few changes to the world supply demand numbers. Beans and wheat were largely unchanged from last month. The world corn carryout total was reduced by 2.36 million tons (-0.8%), which was the largest change made to the world numbers.

The USDA also left their South American production estimates unchanged this month.

Friday?s USDA report had very limited impact on prices. Even though the government cut exports, the corn market traded higher following the release of the numbers. Soybeans also were able to move higher after the numbers came out, but wheat prices slid on the lack of improved numbers.

Source: USDA, Reuters, StoneX