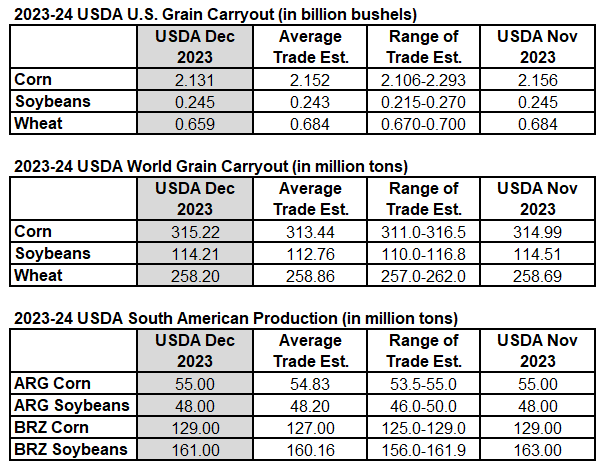

US corn and wheat stocks slightly smaller. Bean numbers unchanged.

The market appeared disappointed. The USDA did not make a reduction to the Brazilian crop as traders expected, and the global soybean ending stocks continue to be very large and painting a Big Red Bar on our charts.

Bean prices have been stuck in a downtrend which keeps commodity funds active on the sell side of their order pad. On the other side of the order pad, we continue to hear from Brazilian producers concerned about their soybean crop, while the biggest buyer in the world, China, has been active.

We have Sell Signals in wheat. This is the time to decide if you need to complete your sales. There was little change in the wheat numbers, but the market reaction remains negative. The world continues to make large wheat purchases out of Russia.

This week we had the commodity funds helping the wheat market and prices remain well above the green line 20-day moving average. Commodity funds remain heavily short the wheat markets, we should see more buying from them with prices in an uptrend.

The corn market has moved up above the green line 20-day average this week, but as we are writing these comments, prices are right back down on the green line. Today?s report offered little for either the bull or the bear. This week CONAB reported that Brazilian corn acres would be down by 5.3% due to the late planning of beans.

Meanwhile, we remain in the middle of a South American weather market.

Source: USDA, Bloomberg, StoneX