USDA report numbers positive, price action not so much

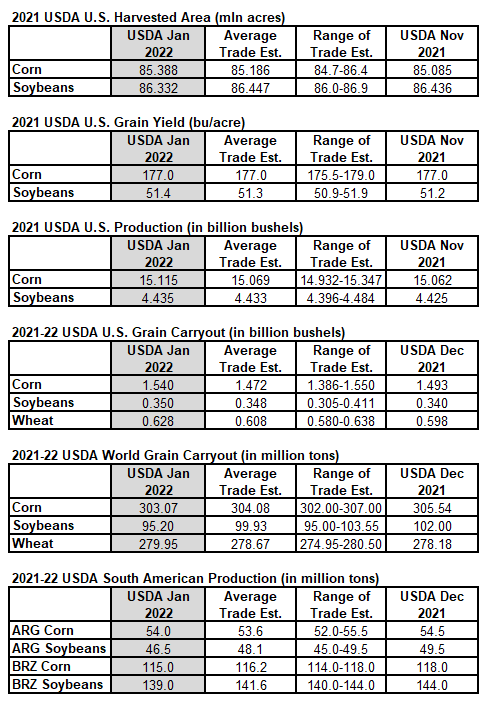

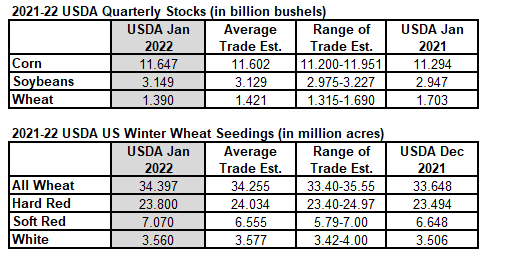

The U.S. corn and bean crops were increased slightly, and winter wheat plantings were also slightly larger than traders expected.

U.S. carryout for corn, wheat, and beans were also slightly larger than trade estimates.

South American crops were slightly smaller than traders expected and world carryout for beans was 4.7 million tons below the average trade guess; world corn carryout was down 1 million tons from guesses, while world wheat carryout was 0.7 million tons larger.

Taking the numbers at face value, one would expect prices across all the crop markets to be higher. But only beans have been able to maintain strength with wheat double digits lower. Corn has been mostly lower since the reports were released.

Beans should go higher, and corn should follow along, but the weakness in wheat is disconcerting. We have learned to be cautious in corn and beans this year when the wheat market is falling.

The sharply lower trade in beans is also baffling and we don?t like corn breaking below the green line 20-day moving average. Color us cautious but we don?t like it when positive reports give negative price action and that is where we are at the moment.

Hopefully the picture will be clearer as we move toward today?s close.

Source: USDA, StoneX, Reuters