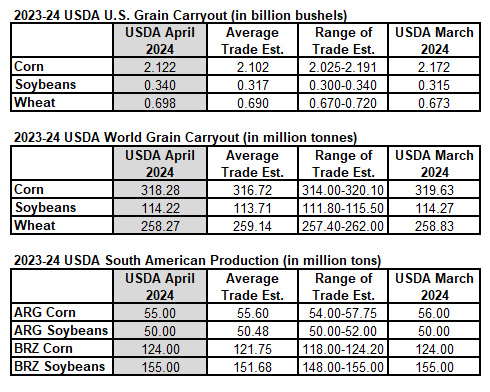

USDA report contained only small adjustments this month

Traders see today?s fundamental forecast showing more than adequate supplies and ending stocks. The South American corn crop is still at risk and the USDA has refused to lower their estimate as far as private trade estimates have fallen. All of the northern hemisphere crops are into their risk periods.

We have written virtually that same paragraph following each one of the most recent reports. The numbers have not really changed much since last fall, except the South American crops turned out to be smaller than expected. Today?s fundamentals have been well traded in recent weeks. There were no surprises today.

Now we are all focused don?t he growing conditions in all the major production areas in the world, especially the United States. Most areas are off to a pretty good start but it is just April and too soon to tell how good crops are going to be.

Today?s fundamentals tell traders that prices will be cheap this fall if we don?t have any weather problems in the United States or some other kind of black swan event that changes the way we view food prices.

Source: USDA, Reuters, StoneX