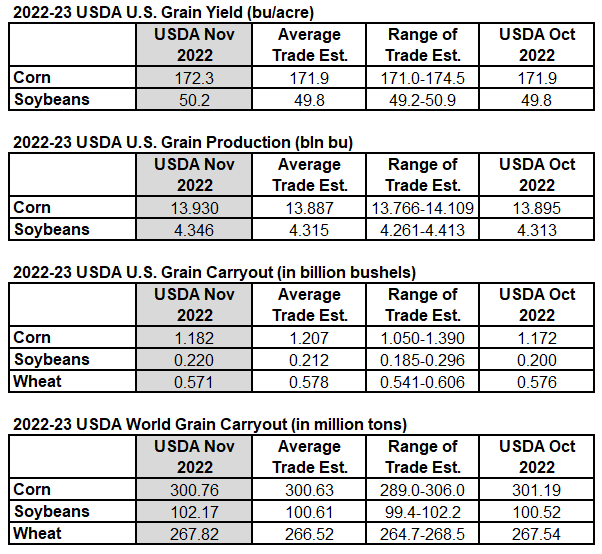

USDA raises corn and bean yields slightly; little change in stocks.

Although it was not immediately apparent in the USDA supply demand report, Argentina is moving into a key role in world corn prices.

The USDA forecast total world coarse grain exports at 225.12 million metric tons in today?s report. 59.22 million tons were forecast to be shipped from the United States, with 46.5 million tons from Argentina, and 47.03 million tons from Brazil. That Argentine number was down half a million tons from last month.

Drought in Argentina is threatening their corn crop and moving that country into a more important role in corn prices. Our weather consultant didn?t see immediate relief for the Argentine drought in his report this morning.

The majority of the Brazilian corn crop is planted as a second crop following soybeans and won?t have much impact on our market for several months.

Meanwhile, corn prices have been beat down due to low water in the Mississippi and discounted feed grain prices in the Black Sea region. Our system is giving us the sixth day of a Buy Signal on corn, with prices as cheap as they?ve been since September.

If you are wanting to re-own sold corn or purchase feed needs, this is a good time to do it.

Today?s USDA report did not change soybean fundamentals, available US supplies are still relatively tight, and a monster crop is being planted in Brazil.

Today we saw another round of soybean purchases by China. The US is about the only store in town until the Brazilian crop harvest. Midwest rains have helped the low water conditions in the Mississippi River and soybean oil demand has been strong due to tight diesel supplies.

US wheat carryover was reduced by 5 million bushels. Traders are much more interested in the crop conditions in US winter wheat country where it is too dry. The US winter wheat crop was rated just 30% good to excellent (51% five-year average) in Monday?s Crop Progress report.

All three of the crop markets we follow have been in trading ranges for weeks. There wasn?t enough fundamental change in today?s reports to take us out of those trading ranges immediately. Keep an eye on South American weather.

Source: USDA, Reuters