USDA soybean yield estimate smaller than expected at 50.5 bpa

Soybeans

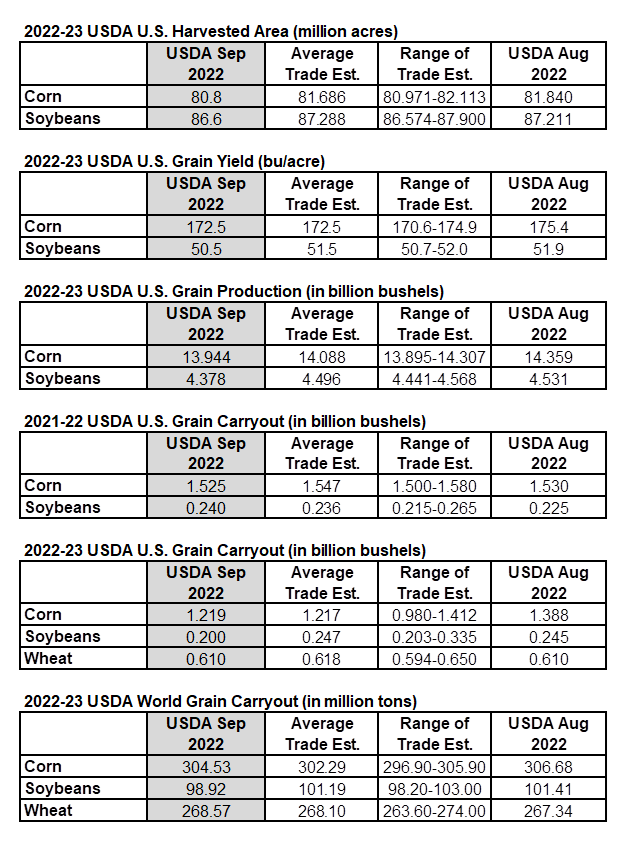

The surprise in the USDA numbers came in a lower than expected US soybean yield estimate. The USDA cut their US soybean yield estimate from 51.9 bpa in August to 50.5 bpa in this month?s report. This was smaller than the low end of the trade estimate range.

The USDA also cut the soybean harvested acreage estimate by 1% from last month, dropping it down to 86.6 million acres. This was 611,000 acres smaller than the average trade estimate.

The reduced bean yield and acreage numbers put the estimate for total soybean production at 4.378 billion bushels, which is 153 million bushels below the August report and 118 million bushels below the average trade estimate.

Crush (-20 million bushels) and export (-70 million) estimates were both reduced. Overall, this dropped the 2022-23 US soybean carryout to 200 million bushels, down from 245 million in August. The average trade estimate was for a slight increase in soybean carryout.

The tighter supply numbers sent bean prices higher immediately after the report release.

World soybean carryout was reduced by nearly 2.5 million tons, dropping the USDA estimate below the 100 million ton mark to 98.92 million tons.

Corn

The USDA had fewer changes for the corn market. They lowered their US corn yield estimate to 172.5 bpa, which was exactly equal to the average trade estimate, so there was no surprise for corn yield like there was for beans.

The USDA did lower their harvested acreage estimate for corn 1.3%, down to 80.8 million acres. This was 886,000 acres smaller than the average trade estimate.

The lower acreage estimate reduced the USDA corn production estimate by 415 million bushels to 13.944 billion bushels. This was 144 million bushels lower than the average trade estimate.

However, the corn carryout estimate was essentially equal to the average trade estimate at 1.219 billion bushels. The lower corn production estimate was offset by smaller feed and residual use (-100 million bushels), exports (-100 million) and corn used for ethanol (-50 million).

The world corn carryout was reduced by 2.15 million tons to 304.53 million tons, which was larger than trade expected.

Wheat

The USDA left their US wheat carryout estimate unchanged from August at 610 million bushels. They increased their world carryout estimate by 1.23 million tons.

Source: USDA, StoneX, Reuters