US soybean stocks and plantings smaller than expected.

There weren’t huge surprises in the March 31 USDA reports. Overall, the reports trended bullish for soybeans.

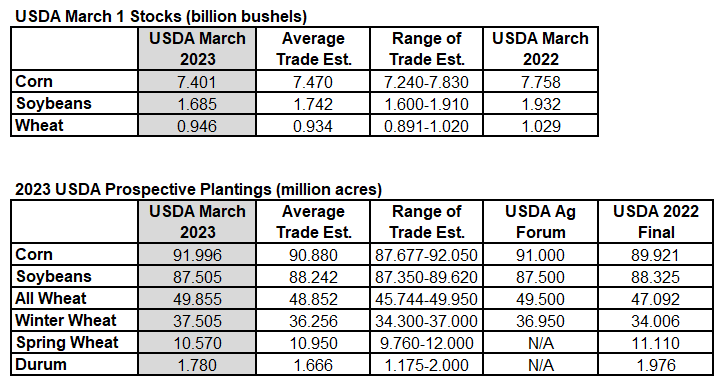

March 1 US soybean stocks were 57 million bushels smaller than the average trade estimate, and intended acres to be planted were 737,000 acres smaller than the trade estimate. Bean prices were quickly up about 30 cents following the report release.

For corn, March 1 stocks were 69 million bushels small than the average trade estimate, but prospective plantings came in 1.116 million acres above the average trade estimate.

Wheat stocks were 12 million bushels larger than expected, and Wheat plantings totaled a little more than 1 million acres larger than the trade expected.

The current rallies are providing an opportunity to dribble a little more corn into the market on our current Sell Signal, and we are not far away from generating a soybean Sell Signal that we are looking forward to making more sales on.

We have learned historically that selling corn in April and beans in May are very good strategies, if there is not a substantial weather problem through the US growing season.

The uncertainty of the South American second corn crop and the entire North American crop, combined with uncertainties in the Black Sea region have pushed our crop markets higher this week.

The bottom line is that until we start to see something develop, we have limited upside potential.

We are happy to have the rallies to make sales on. Keep powder dry for summertime problems.

Source: USDA, Bloomberg