The February USDA reports released Thursday was expected to be largely neutral, and the futures market?s immediate reaction appeared to confirm the predictions.

The ripple effect of the USDA?s bearish forecast on Brazilian soybeans in comparison to Conab?s more-aggressive cuts left futures stuck in place for a while as analysts weighed the ripple effect on U.S. exports and ending stocks. Wheat futures quickly lost a dime or more while corn was little changed as well at midday.

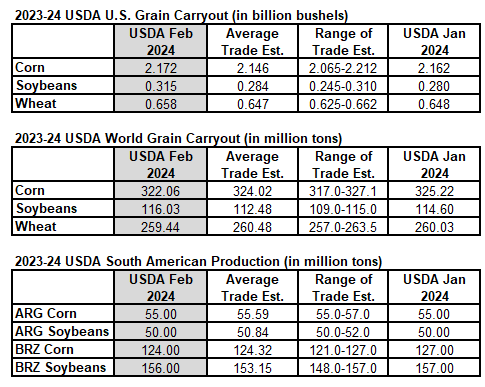

Corn: U.S. ending stocks were increased to 2.172 billion bushels (bbu) based on lower domestic use while global production was reduced on declines in Brazil and Mexico. Foreign The average price projection was unchanged at $4.80 per bushel.

Soybeans: Slower exports cut the export forecast for the year by 35 MMT from January, leading to a new total of 1.72 bbu. Ending stocks were raised to 315 million bushels as the crush forecast remained unchanged, trimming the average price to $12.65 per bushel.

Wheat: U.S. wheat supplies for 2023-24 were projected at stable with exports little changed at 725 mbu. Ending stocks were raised to 658 mbu with prices unchanged at $7.20 per bushel. The global supply was increased while ending stocks were trimmed to 259.5 million metric tons (MMT), the lowest since the 2015-16 year.

South America?s 2023-24 production estimates were within expectations and not significantly changed from last month?s USDA projections. Brazil?s soybeans slipped to 156 MMT from 157 MMT. Corn was lowered from 127 MMT in January to 124 MMT, which was nary equal to the average estimates. Earlier in the day, Brazil?s Conab lowered its soybean projection to 149.4 MMT; the corn crop was cut 113.7 MMT and the outlook for the safrinha crop? outlook was trimmed to 88.1 MMT. Projections for Argentina were unchanged from January and even with analysts? predictions.

Source: USDA, Reuters, StoneX