USDA reports mostly unchanged from last month

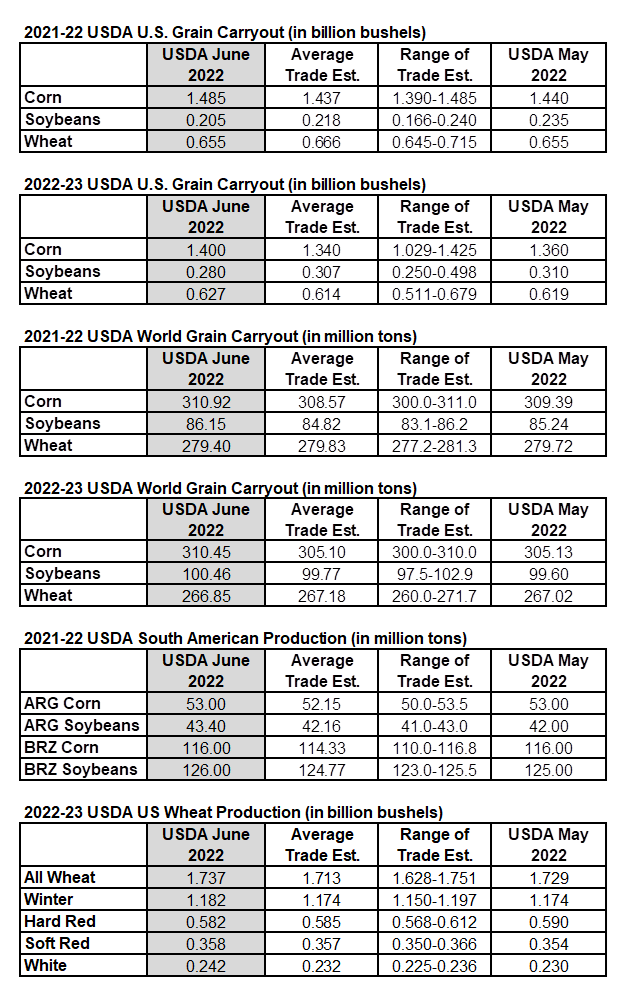

Small adjustments in U.S. beginning stocks numbers (-30 million bushels for beans; +45 million bushels for corn) were the biggest changes seen on USDA reports Friday. U.S. corn and soybean acreage and yield estimates were left unchanged from last month. Usage changes were insignificant.

U.S. wheat yield was increased 0.3 bpa to 46.9 bpa, which increased production by 8 million bushels. U.S. wheat ending stocks increased by the same 8 million bushels.

Global wheat stocks were reduced less than a million tons, while bean stocks were increased nearly a million tons, and corn stocks increased 5 million tons from last months report.

Although the corn numbers were larger than traders expected, corn prices didn?t take long to recover losses and move higher on the day.

The USDA left Ukraine?s 2022-23 supply demand table for wheat unchanged from last month. They increased Ukraine?s 2022-23 corn production by 5.5 million metric tons and left exports unchanged at 9 million tons (23 million last year).

The USDA made small increases to their South American soybean production estimates but left their corn production estimates unchanged.

Traders did not get any significant number change in the fundamentals. Weather forecasts are signaling the potential for hot dry conditions over the next two weeks, which is much more important to traders than Friday?s USDA report.

Source: USDA, StoneX, Reuters