Corn production larger, beans and wheat as traders expected

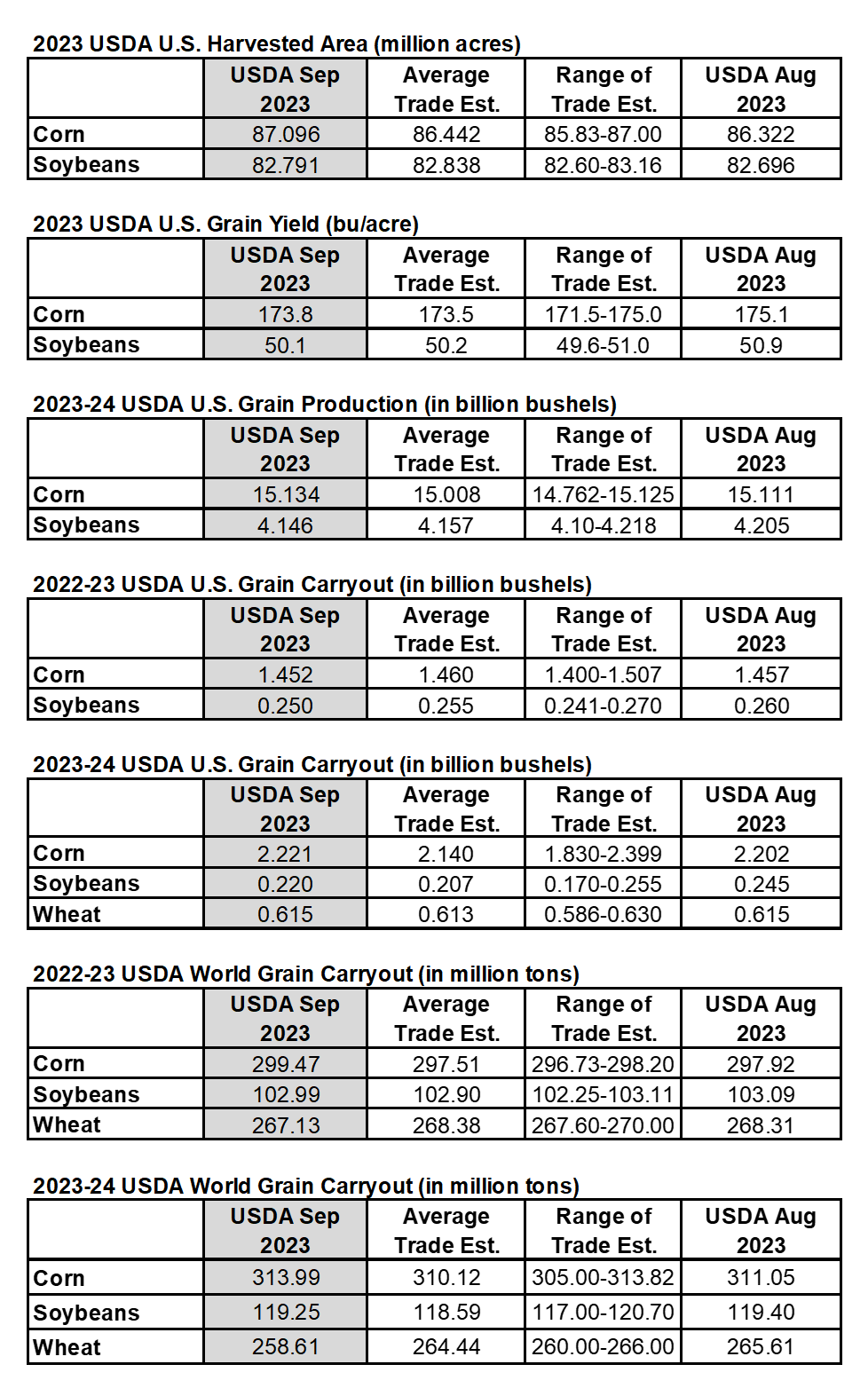

The USDA found more corn and bean acres in their September report. Corn plantings were increased by 774,000 acres and bean plantings by 95,000 acres. The average corn yield was pulled down 1.3 bpa to 173.8 bpa and the soybean yield was 0.8 bpa lower at 50.1 bpa. Both yield estimates were in line with trade expectations.

The net result was an increase in corn production of 23 million bushels to 15.134 billion bushels. If they are correct, it would be a record corn crop by 60 million bushels. Bean production was estimated at 4.146 billion bushels, a decrease of 59 bushels from the August estimate. This would be a large bean production but well below record level.

US corn usage estimates were unchanged this month. All US supply demand numbers for wheat were left unchanged this month.

The soybean crush forecast is reduced 10 million bushels and the export forecast is reduced 35 million bushels on lower supplies. Ending stocks are projected at 220 million bushels, down 25 million from last month.

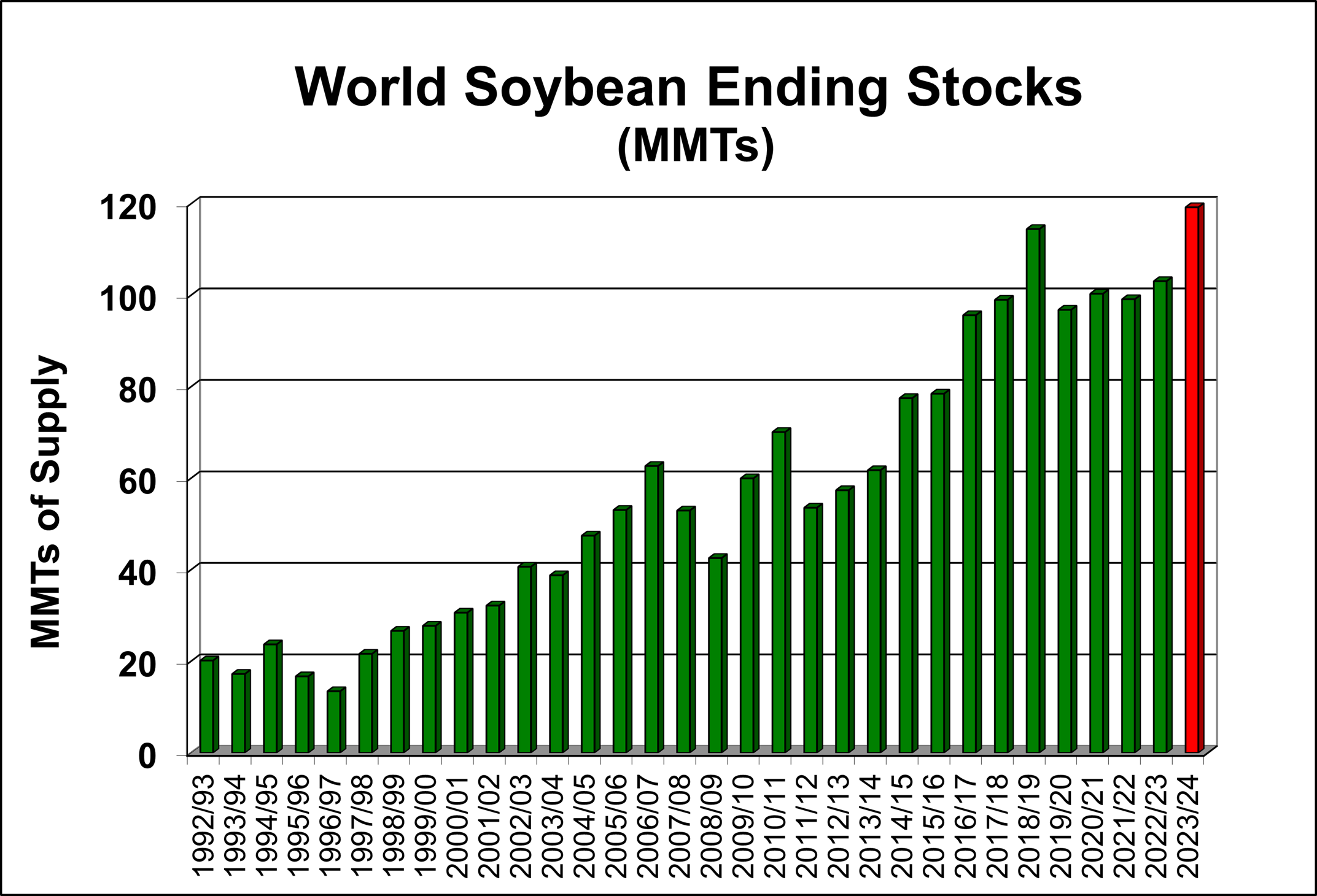

The USDA did not reduce the 2023-24 world soybean ending stocks enough to make us feel comfortable. The graph below shows today?s USDA world soybean stocks estimate compared to history. Unless something changes, we need to make sure we wrap up soybean sales during Brazil?s growing season.

Wheat was the only market today able to overcome active selling activity. After setting a new low for this move, prices bounced higher on the day in all three types of wheat. Traders may have been reacting to the USDA slightly tightening world wheat stocks, but we think it is more.

As you know, we only get so many days of Buy Signals before markets turn around. Today was Day 26 of the Chicago wheat Buy Signal. Prices have dropped sharply during this period. We think that is about enough.

Source: USDA

Source: USDA, Bloomberg